Banner

Tannenbaum crony Rees ordered to cough R160m

ANT KATZ

High-living fugitive Dean Rees, pictured above, the lawyer accused of being one of the masterminds of Barry Tannenbaum’s R12,5 billion Ponzi scheme, was ordered by a court last week Friday to repay R158,9m to swindled investors.

BUSINESS DAY reports that more than 880 investors – including former CEOs of Pick n Pay and the JSE as well as British and Australian CEOs – were suckered into ploughing billions into South Africa’s biggest white-collar con, ostensibly to buy components of Aids drugs, until it went belly-up in May 2009.

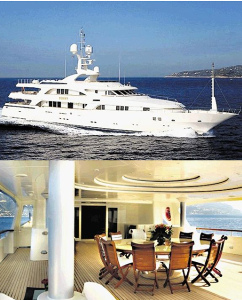

RIGHT: The conmen served R5 000 a bottle French champagne on this half-million a day rented yacht on the Med to lure their investors

On Friday Justice Boissie Mbha of the Johannesburg High Court, ruled that Rees had to pay R158,9m to the trustees of Tannenbaum’s estate, saying he was an integral cog in Tannenbaum’s swindle. The trustees have already recovered R114m paid to another lawyer who acted as an agent, sports-car enthusiast Darryl Leigh.

The judgment makes a mockery of Rees’ efforts to claim that he had no idea it was a scam, and that he too was simply conned by Tannenbaum, grandson of the founder of drug maker Adcock Ingram.

“https://www.sajr.co.za/images/default-source/test/9f-tannenbaum-home.jpg” alt=”9f-Tannenbaum HOME” title=”9f-Tannenbaum HOME” />

LEFT: Business Times editor Rob Rose’s tell-all book published recently, exposed startling new facts on the Ponzi scheme that fleeced wealthy businessmen of

Warrants of arrest have been issued for both, but the National Prosecuting Authority (NPA) has yet to extradite either.

The matter was in the hands of former senior NPA prosecutor and now a DA MP, Glynnis Breytenbach, when she was suspended in a political tryst by the NPA.

When she won her reinstatement case, she was moved to a different office and no further movement would appear to have been initiated in the extradition proceedings against either man.

Comfortably ensconced near Runaway Bay

Tannenbaum remains comfortably ensconced near Runaway Bay on Australia’s Gold Coast where he works at insurance company Qantum, while Rees moved to a chateau in Switzerland in 2009.

Tannenbaum’s bank statements show that Rees was paid R150,9m in the heady days from 2007 to 2009 before the scheme collapsed.

The trustees argued that these were “commissions” for luring other investors into the scheme – a claim Rees has continued to deny.

But the witnesses who testified painted a picture of a man living a lavish lifestyle, fuelled by Ponzi money.

Justice Mbha said the evidence showed that fancy gold watches, first-class air travel, entertainment, booze and home renovations, were all bought with the more than R170m that flowed through his various accounts.

RIGHT: The Sunday Times exposed the high-flying style of entertainment which Rees and Tannenbaum used to lure their investors

RIGHT: The Sunday Times exposed the high-flying style of entertainment which Rees and Tannenbaum used to lure their investors

However, a person close to the trustees said that Rees had few assets left in South Africa. “A judgment is a judgment. To find his assets and get the money, well that’s another story,” he said.

Pedro Pinho, Rees’ former accountant, told the court how he “noticed from early on that there were a lot of Rees’ expenses which were quite obviously personal in nature and not business-related, going through [his] accounts” from investors’ money.

CLICK FOR 58 TANNENBAUM-RELATED READS ON SAJR ONLINE

Said Justice Mbha: “Rees even referred to investors as ‘those idiots’, thus displaying his total and callous disregard for investors. Clearly, he never gave a second thought to the immorality of using monies entrusted to him to bankroll his, and his wife’s, lavish lifestyle.”

E-mails between Tannenbaum and Rees were produced to prove both of them knew it was a scam. In one e-mail in October 2008, eight months before the crash, Tannenbaum wrote to Rees: “Feels as if the rivers are slowing – know what I mean?”

Rees’ lawyers argued in court that much of this evidence was simply “hearsay” and that there was no way he knew it was a scam.

However, this judgment may prove a pyrrhic victory for the trustees of Tannenbaum’s estate, who have sought to recover cash which can then, theoretically, be divided among the investors.

Dean Rees

November 17, 2014 at 4:28 am

‘What a crock of absolute crap. I am not a damn crony and lets see who was not mashugana to turn away the cash when it came to recoveries. They were lawyers.

\n

\nHow much has been repatriated back to investors?

\n

\nAll my assets were surrendered, but Oy Vey, blame someone else. Crony bla bla. DL, JR, CD, RG and it goes on.

\n

\n

\n

\n

Hi Dean, nice to have you on the website. We have

\nremoved the names and replaced them with initials

\nfor legal reasons. -EDITOR

\n

\n

‘

Arnold Davis

March 31, 2016 at 7:59 am

‘Oops!!! You should have said Mr.Crony… especially with all that money it entitles him to be called a Mr.’